Chemical companies continue to invest in hand sanitiser in response to the Covid-19 pandemic. A large number of them are now producing in significant volumes.

Ineos, the largest European producer of the two key raw materials - isopropyl alcohol (IPA) and ethanol – has announced its intention to produce 1 million bottles of hand sanitiser/month from each of three newly built facilities in the UK, Germany and France.

As of the end of March, the company has hit its target of building the first plant near Middlesbrough, UK. It will supply hospitals free of charge “during the crisis period” and is in discussions with retailers.

Dow announced on 30 March that its sites at Auburn, Michigan; South Charleston, West Virginia; Seneffe, Belgium; and Hortolândia, Brazil “possess the necessary raw material handling, mixing and packaging capabilities and will produce hand sanitiser”. They join the site at Stade, Germany, which is already manufacturing it.

Dow, like Ineos, was already producing raw materials, said that it could adapt its capabilities for downstream production with “little to no impact to normal operations”. Auburn can produce 7 tonnes/week and similar volumes are expected at the other sites. Once all are at full production, the company expects to produce 200 tonnes.

All of the hand sanitiser that will be produced has been allocated, with the majority for donation to state and regional health systems and government agencies for distribution. It will also be distributed to Dow production sites to help protect frontline employees. The first deliveries are expected to begin in the first week of April.

Plant-based ingredients firm Roquette has adapted one of its pilot lines at its site in Lestrem, France, to manufacture about 5,000 litres/week of a hydro-alcoholic disinfectant solution. The first shipments were sent to Lille University Hospital Centre, the French Blood Donors Organisation and to other local health facilities, in coordination with the Hauts-de-France Regional Health Agency and the local authorities.

In Germany, Wacker donated 15,000 litres of hand sanitiser for the production of disinfectants to Bavarian hospitals and care facilities at the request of the state Ministry of Economic Affairs. The alcohol needed, 11,000 liters of 2-propanol, was transported from Nünchritz, Saxony, to the Gendorf chemical industry park in Bavaria to be mixed and sent to an official distribution centre.

Swiss pharmaceutical CMDO Siegfried is also supplying disinfectant in those regions where it operates production sites, including the Swiss cantons of Aargau and Valais and around Minden in Germany. “The service including delivery is free of charge to the extent possible,” the company said, adding that it will not supply private or commercial organisations.

Meanwhile, Croda International said that it has gifted enough glycerine to regular customers to manufacture five million 250 ml bottles of hand sanitiser, assuming 2% glycerine content. It is also donating saponin vaccine adjuvants to projects working on a vaccine. The company plans to review with customers where more glycerine could be gifted.

Similarly in the US, Amyris, which is in discussions for the testing of its fermentation-derived squalene as a vaccine adjuvant for a Covid-19 vaccine, has launched its own No Compromise Pipette Baby branded hand sanitiser. The company said that it “will not price its hand sanitiser at a premium, and plans to donate part of the supply to front-line health staffers and medical personnel”. It plans to produce 30,000 units in the first few weeks.

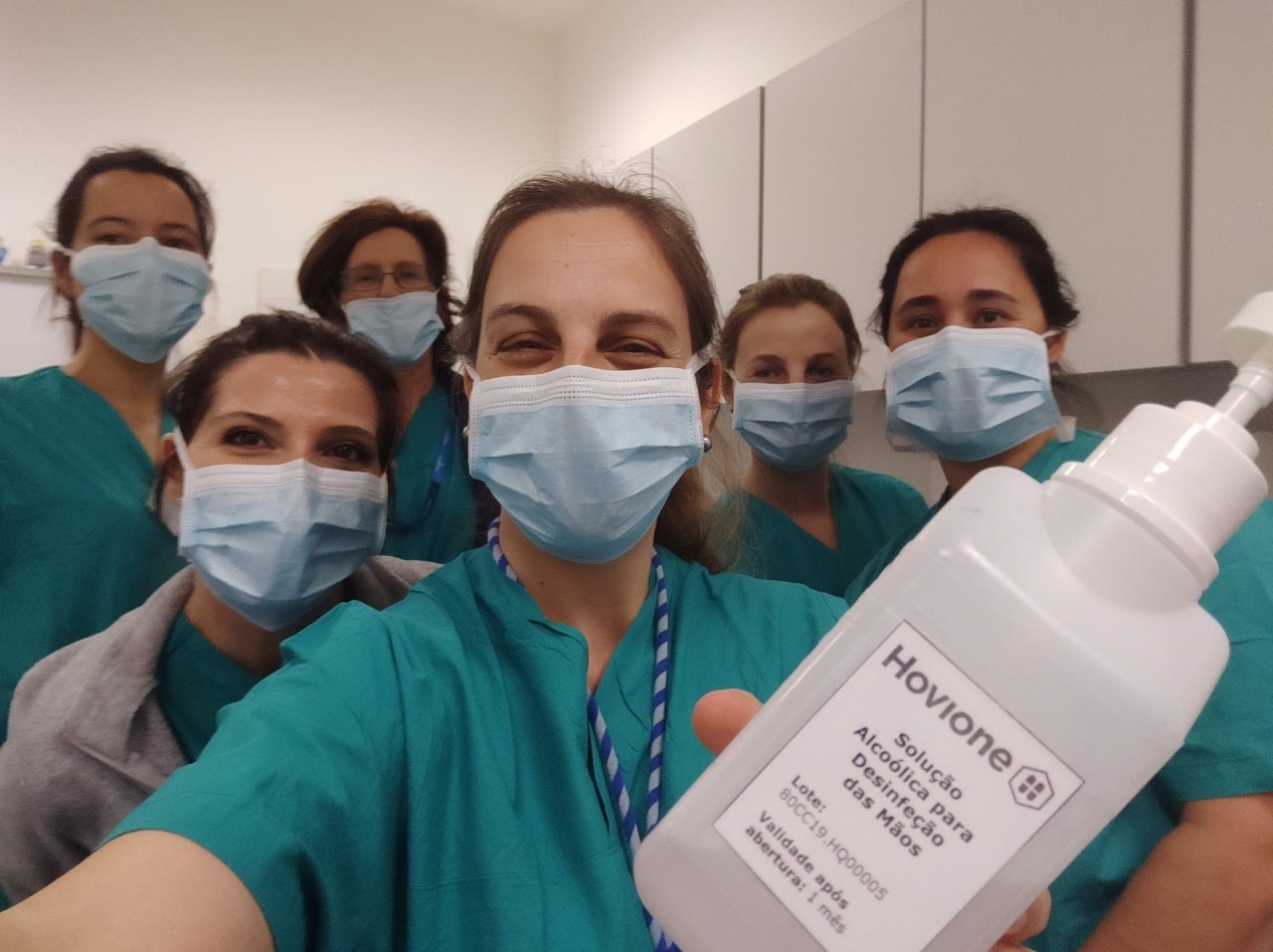

Portugal’s Hovione began producing IPA- and ethanol-based hand sanitiser to a WHO formulation at tonne-scale for itself when supplies were short, it has emerged. The company, another major pharmaceutical CDMO, is now supplying the material free to Portuguese hospitals. Volumes were expected to reach 30 tonnes by the end of the month.

Earlier in March, Lanxess added a second shift at its site in Sudbury, UK, to boost production of Vikron sanitiser. Earlier, BASF announced plans to produce hand sanitisers at Ludwigshafen and supply them to hospitals in the Rhine-Neckar metropolitan region. The company has now reallocated tonnes of raw materials, especially IPA, for making the sanitisers and secured legal official permission to make them.

Similarly, Huntsman and Syngenta began making hydro alcoholic solution to produce hand sanitiser at Monthey, Switzerland, for free-of-charge supply to hospitals and pharmacies in the Canton of Vaud and the General Hospital in Lausanne. Plans were to ramp up production to 3-5 tonnes/week. Arkema has repurpose da production line at its Rhône-Alpes Research Centre in order to make 20 tonnes/week of alcohol-based solution to be distributed free of charge for the mass restocking of public hospitals.

The effort is not limited to chemical companies, of course. Flavours and fragrance giant Firmenich has shifted production at La Plaine, Switzerland, to disinfectant solution, while luxury goods maker LVMH and many manufacturers and distillers of spirits on both sides of the Atlantic have also switched production.

Read the article at Specchemonline